How do I disconnect from Xero?

You can find your connection info on the configuration page of the Sales or Purchases integration process (the first step). To disconnect from Xero, click on the “Disconnect from Xero” button on this page.

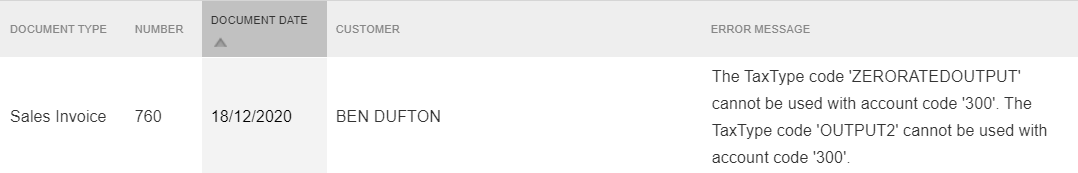

How do I fix validation error: The TaxType code ‘XXXX’ cannot be used with account code ‘YYYY’

This is the most common validation error, and is usually caused by misconfiguration of your VAT Rates’ or Nominal Codes’ linked Xero Tax Type or Account Code, or by having the wrong Nominal Code on your VGM document line items.

To fix this issue, first log in to VGM and find the document referenced in the validation error message (for example, Sales Invoice 760 in the image below). Check that all the line items on the document are using the correct nominal codes – for example, ensuring that all items on a Sales document are using a Sales nominal code.

If they all have a valid nominal code assigned, then check in the Company Portal that all your VAT Rates have the correct Xero Tax Type linked to them, and that all your Nominal Codes have the correct Xero Account Code linked to them. Sales Integration exports can only use Sales Tax Types and Account Codes from Xero, and Purchases Integration exports can only use Purchase Tax Types and Account Codes from Xero.